Prévoyance

La CPEG en deux mots

La CPEG est une caisse publique fonctionnant selon le régime de la primauté des prestations (la rente est définie selon le dernier salaire assuré).

Son plan de prévoyance est décrit dans le Règlement général de la CPEG, ainsi que dans le Guide de votre prévoyance, au 2e chapitre (voir sous Documents). En voici quelques principes de base.

Le taux de cotisation s’élève à 27% du traitement cotisant et est prise en charge pour 1/3 par l’assuré·e et 2/3 par l’employeur.

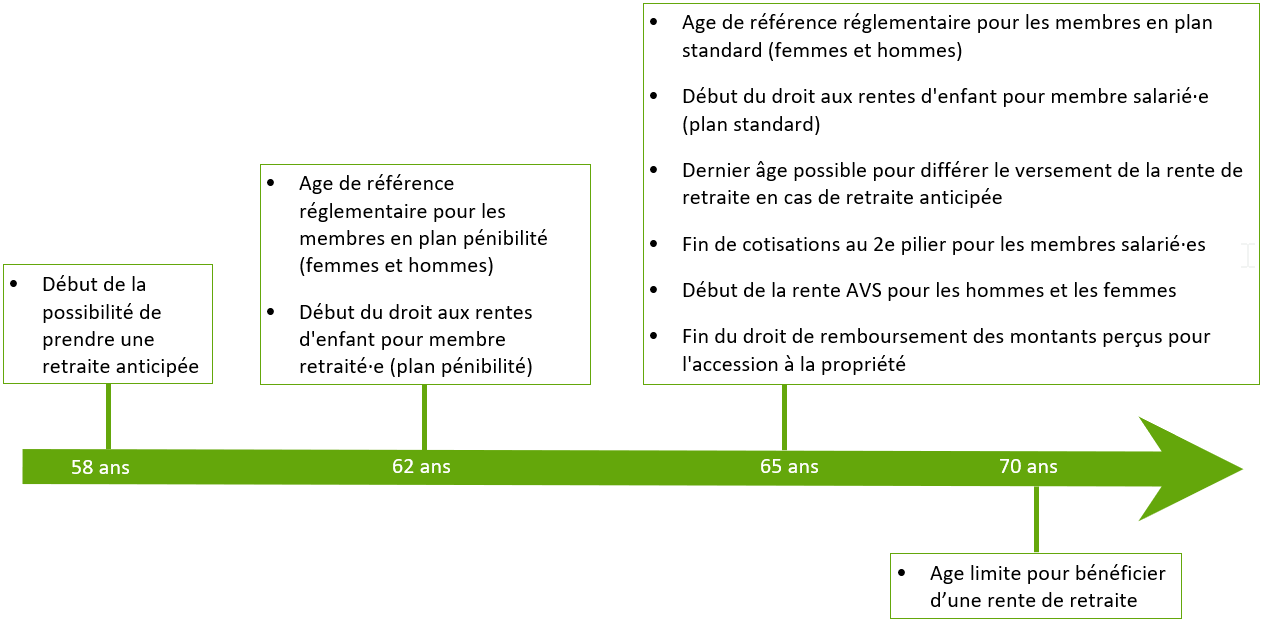

L’âge permettant de partir en retraite avec un taux de pension de 60% (appelé “âge de référence réglementaire”) est fixé à 65 ans pour le plan standard (62 ans pour les activités physiquement pénibles).

Pour une durée de cotisation de 40 ans, la retraite équivaut à 60% du dernier salaire assuré.

Il est possible d’anticiper partiellement ou entièrement sa retraite dès l’âge de 58 ans, moyennant une baisse des prestations.

Bienvenue!

En commençant votre activité auprès de votre nouvel employeur affilié à la CPEG, vous devez demander à votre ancienne caisse de pension qu’elle transfère à la CPEG l’avoir accumulé (dit prestation de libre passage, ou PLP) auprès de celle-ci .

La Caisse crédite la PLP reçue et vous permet ainsi d’améliorer vos prestations sur la base de celles prévues par la CPEG.

Bon à savoir

- Plus tôt ce transfert sera fait, plus l’impact sur l’amélioration des prestations sera important.

- Si votre capital est sur un compte bloqué (en raison par exemple d’une interruption de votre

activité professionnelle), il est important de le verser rapidement pour ne pas courir le risque

d’oublier son existence. - Si c’est votre premier emploi en Suisse, il n’y a pas de transfert de PLP à effectuer.

- Si vous avez moins de 20 ans, vous êtes couvert·e pour les risques invalidité et décès. Vous

n’avez pas de transfert de PLP à effectuer. - Si votre ancien employeur était également affilié à la CPEG, vous n’avez

rien à effectuer, le transfert de votre PLP se fera en interne.

Pour plus de détails sur la PLP, consulter le guide publié par la Confédération (en neuf langues) :

Prestations de libre passage : n’oubliez pas vos avoirs de prévoyance!

Quelques explications en images

- Votre employeur nous annonce la date de début de votre engagement.

- La CPEG vous envoie un courrier de bienvenue (dite lettre d’affiliation) contenant toutes les

informations nécessaires pour effectuer le transfert de fonds de votre ancienne caisse à la

CPEG. - Vous faites les démarches auprès de votre ancienne caisse, en demandant le transfert de votre

PLP. Cette demande peut se faire avec le formulaire de votre ancienne caisse si elle vous en

envoie un ou directement par une lettre de votre part lui indiquant les coordonnées bancaires

de la CPEG figurant dans notre courrier de bienvenue. - La CPEG ne peut accepter qu’un montant limité aux prestations maximales prévues par son règlement. Si vous voulez vous assurer que vos avoirs ne dépassent pas ce plafond, nous vous recommandons de prendre contact préalablement avec un·e de nos gestionnaires.

- La CPEG enregistre le transfert en accusant réception des fonds reçus. Sur demande, vous pouvez obtenir un certificat d’assurance tenant compte de ce transfert.

Les coordonnées bancaires de la CPEG sont les suivantes :

- Établissement bancaire : Banque Cantonale de Genève, 1211 Genève 2

- Propriétaire du compte : CPEG, Esplanade de Pont-Rouge 5,

1212 Grand-Lancy - IBAN : CH96 0078 8000 0504 0931 7

- SWIFT/BIC : BCGECHGGXXX

- Clearing : 788

Documents

En général

Dans cette partie, vous trouverez les informations sur ce qu’il convient de savoir à l’occasion de votre mariage, de votre divorce, d’un changement d’état civil ou d’adresse.

De manière générale, tous les changements dans votre situation personnelle doivent être annoncés à votre employeur, qui transmet l’information à la CPEG.

Les prestations étant calculées sur les données transmises par l’employeur, il est important que celles-ci soient rapidement mises à jour, afin que vos prestations soient conformes à votre situation. Nous vous recommandons de contrôler toutes les données reçues de la CPEG et, si celles-ci devaient ne plus correspondre à la réalité, d’en informer votre employeur pour qu’il nous communique les modifications à effectuer.

Quelques explications en images

Changement d’adresse ou d’état civil

En cas de changement d’adresse ou de changement d’état civil, vous devez l’annoncer à votre employeur. Votre employeur communique ces informations à la Caisse qui adaptera vos données personnelles.

Mariage/Partenariat enregistré

Après votre mariage civil ou votre partenariat enregistré fédéral, vous informez votre employeur de votre mariage (ou partenariat) et de sa date.

Votre employeur communique ces informations à la Caisse qui adaptera vos données personnelles.

Nous attirons votre attention sur le fait que les couples au bénéfice d’un partenariat cantonal, ou d’un autre pays, ne peuvent pas bénéficier d’une rente de partenaire survivant·e. Il n’y a pas de date à communiquer dans ce cas.

Naissance/Adoption

En cas de naissance ou d’adoption, vous devez l’annoncer à votre employeur, en vue d’obtenir les allocations familiales.

Votre employeur communique à la Caisse cette information, qui vient compléter vos données personnelles.

Divorce/Dissolution de partenariat

Lors d’un divorce (quel que soit le régime matrimonial et même si une contribution d’entretien est prévue) ou d’une dissolution judiciaire du partenariat enregistré, les prétentions de la prévoyance professionnelle acquises durant l’union sont partagées entre les conjoint∙es ou les partenaires enregistré·es (principe du partage des prétentions de la prévoyance professionnelle).

Si, consécutivement à un divorce ou à une dissolution d’un partenariat, une partie de votre avoir accumulé doit être transférée à votre ex-conjoint·e, vos prestations seront réduites. Une information sur cette réduction et les possibilités qui vous sont offertes pour la compenser vous seront transmises par la CPEG. Dans le cas où c’est vous qui seriez bénéficiaire d’un versement, la CPEG vous informera de l’augmentation de vos prestations.

Divorce en Suisse

Vous devez demander à la Caisse les éléments que vous devez transmettre à la ou au juge pour qu’elle ou il puisse effectuer le calcul du partage.

Si votre mariage a précédé votre affiliation à notre Caisse, vous devez nous informer de votre situation au moment du mariage : étiez-vous en étude, salarié·e, sans travail ? Avez-vous effectué tous vos transferts auprès de notre Caisse ?

Le tribunal communique à la CPEG les dispositions du jugement relatives au partage de votre avoir de prévoyance, y compris les indications nécessaires au transfert du montant défini par le jugement.

Divorce à l’étranger

La compétence des tribunaux suisses est exclusive pour le partage de prétentions de prévoyance professionnelle envers une institution suisse de prévoyance professionnelle.

La nature exclusive de la compétence suisse a pour conséquence que :

- les avoirs de prévoyance suisses ne peuvent être répartis, en cas de divorce à l’étranger, que par un·e juge suisse, même si la ou le juge étranger ou étrangère du divorce a tenu compte des avoirs de prévoyance suisse dans son jugement de divorce ;

- une décision étrangère qui porte sur des avoirs suisses n’est pas reconnue.

Ainsi, vous pouvez agir en complément de votre jugement de divorce étranger par-devant les autorités suisses, en saisissant le Tribunal de première instance de Genève.

Dans le cadre d’une procédure de divorce*, la prestation de libre passage de chacun des époux acquise durant le mariage/partenariat enregistré est en principe partagée en deux.

Si vous souhaitez connaître le montant de votre prestation de libre passage acquise durant le mariage/partenariat enregistré, vous devez adresser à la Caisse une demande écrite mentionnant les points suivants:

- la date de votre mariage/partenariat enregistré (jour, mois, année)

- toutes informations relatives à vos·votre précédent·s rapport·s de prévoyance (décompte·s de sortie, décompte·s de libre passage, certificat·s d’assurance, etc.) ou confirmation qu’il n’existe aucun autre rapport de prévoyance

- le nom et les coordonnées de vos·votre précédente·s caisse·s de prévoyance ainsi que la·les date·s d’affiliation (entrée dans la caisse) et la·les date·s de sortie

- si les prestations de libre passage accumulées depuis le début de votre carrière ont été transférées auprès de notre Caisse ou, dans la négative, ce qu’il en est advenu (remboursement en espèces, versement anticipé dans le cadre de l’encouragement à la propriété, versement sur un compte bloqué ou une police de libre passage etc.).

* Selon l’article 22d LFLP, les dispositions applicables en cas de divorce s’appliquent par analogie à la dissolution judiciaire d’un partenariat enregistré.

En général

Vous trouverez ici tout ce qu’il convient de savoir à l’occasion des différents changements qui peuvent intervenir dans votre situation professionnelle durant votre affiliation à la Caisse.

Congé sans traitement

Si votre employeur vous autorise à prendre un congé sans rémunération, dont la durée est supérieure à 1 mois, vous restez affilié·e à la CPEG au maximum pendant 3 ans.

Bon à savoir

- Durant votre congé sans traitement, vous êtes assuré·e pour les risques décès et invalidité.

- Durant cette période, votre taux d’activité est considéré comme étant à 0% et vous ne versez aucune cotisation. Par conséquent vos prestations à la retraite baisseront.

- A votre retour et après examen de votre situation, il vous sera possible de récupérer les prestations perdues durant votre congé en effectuant ce que l’on appelle un rachat volontaire.

Qui fait quoi ?

- Vous décidez, d’entente avec votre employeur, d’un congé sans solde d’une durée de X mois.

- Votre employeur informe la Caisse de ce congé.

- Le mois de votre reprise, la CPEG procède aux changements liés à votre reprise d’activité et calcule à nouveau le montant des cotisations. C’est à ce moment que vous pouvez effectuer un rachat.

Changement de salaire

Votre salaire a changé par rapport au mois précédent sans changement de taux d’activité.

Bon à savoir

- Si votre salaire change, vos prestations sont calculées sur la base du nouveau salaire et adaptées proportionnellement (à la hausse comme à la baisse).

- Si l’augmentation est consécutive à un changement de classe ou supérieure à un taux d’indexation défini par la Caisse pour chaque employeur n’appliquant pas l’échelle des traitements de l’Etat, l’augmentation des prestations nécessite un financement complémentaire, appelé rappel de cotisations.

Qui fait quoi ?

- Votre employeur nous transmet votre nouveau salaire.

- La CPEG traite cette évolution salariale et détermine si l’augmentation des prestations nécessite un rappel de cotisations. Dans l’affirmative, elle vous envoie un courrier qui vous propose les différentes possibilités de financer ce rappel de cotisations, ainsi que les impacts sur les prestations liés à ce financement.

- A la réception de ce courrier, vous devez informer la Caisse de votre choix (choix du type de financement ou refus). Sans nouvelles de votre part dans un délai de 3 mois, votre choix sera considéré par défaut comme un refus de financer ce rappel.

Changement de taux d'activité

Votre salaire a changé par rapport au mois précédent suite à un changement de taux d’activité.

Bon à savoir

- Un changement de votre taux d’activité peut être lié à un choix personnel ou à une invalidité partielle.

- Si votre taux d’activité change, vos prestations sont calculées sur la base du nouveau salaire effectif et adaptées proportionnellement (à la hausse comme à la baisse).

- En cas de baisse du taux d’activité, vous avez la possibilité, si vous avez plus de 58 ans, de continuer d’être assuré·e sur la base du même taux d’activité, moyennant une cotisation supplémentaire totalement à votre charge. Dans ce cas, vous devez prendre contact avec un·e de nos gestionnaires.

- Si vous avez plus de 58 ans et que la baisse de votre taux d’activité est supérieure à 20%, vous avez la possibilité de demander une rente de retraite partielle. Dans ce cas, vous devez prendre contact avec un∙e de nos gestionnaires.

Qui fait quoi ?

- Votre employeur nous transmet votre nouveau taux d’activité.

- La Caisse calcule les prestations et les cotisations par rapport à ce nouveau taux d’activité.

Arrêt de travail (maladie ou accident)

Bon à savoir

- Les cotisations continuent d’être prélevées tant que le salaire est versé à raison d’au moins 80%.

- Vous restez affilié·e à la CPEG tant que vos rapports de service sont en cours.

- Si votre incapacité se prolonge au-delà du délai de votre droit au salaire, se référer au chapitre Invalidité (prestations provisoires).

- Si l’arrêt de travail débouche sur une pension d’invalidité, voir le chapitre Invalidité.

Changement d’employeurs CPEG

Votre nouvel employeur est également affilié à la CPEG.

Bon à savoir

- Comme vous allez être réengagé·e auprès d’un employeur affilié à la CPEG, vous n’avez pas besoin de tenir compte du courrier de démission envoyé automatiquement.

- Comme vous restez au sein de la CPEG, le transfert de votre libre-passage se fait en interne et vous ne recevrez pas de nouveau certificat d’assurance (sauf en cas de changement de plan).

- Si le changement se fait au-delà de 6 mois (délai au-delà duquel les fonds sont versés automatiquement à la Fondation supplétive), votre retour dans la Caisse sera considéré comme une nouvelle affiliation.

Qui fait quoi ?

- L’employeur que vous quittez informe la Caisse de votre sortie.

- La CPEG traite la sortie. Ce traitement va générer l’envoi automatique d’un courrier de démission.

- Votre nouvel employeur annonce à la CPEG votre entrée.

- La CPEG vous adresse une lettre de bienvenue, même si, formellement, vous n’avez pas quitté la Caisse entre vos deux emplois.

- Si votre nouvel engagement se fait après un délai de 6 mois, vous devez absolument en informer la Caisse, pour éviter que cette dernière ne verse votre prestation de libre-passage à la fondation supplétive.

Au cas où votre nouvel employeur n’est pas affilié à la CPEG, reportez-vous à Sortie de la CPEG.

Changement de plan

Un changement de plan intervient quand vous passez d’une fonction standard à une fonction reconnue comme pénible (ou vice-versa) ou si le caractère de pénibilité de votre activité est nouvellement reconnu par l’Etat.

Bon à savoir

- Les critères de pénibilité (sollicitation physique, influences environnementales et horaires irréguliers) ne sont pas du ressort de la CPEG. Ils sont définis par l’Office du personnel de l’Etat (OPE). Les activités concernées figurent dans une liste publiée par le Conseil d’Etat dans le Règlement d’application de l’art. 23 de la LCPEG. L’activité à pénibilité physique concerne exclusivement les membres salarié·es de la classe 4 à la classe 17 y comprise de l’échelle des traitements.

- Un changement de plan génère une modification de vos prestations à la retraite.

- Le changement de plan n’a pas d’influence sur le taux de la cotisation en cours.

Qui fait quoi ?

- L’Etat informe les employeurs ainsi que la Caisse des fonctions nouvellement reconnues pénibles.

- Votre employeur annonce le caractère à pénibilité de votre fonction à la CPEG.

- La CPEG traite la mutation et vous envoie un courrier vous informant du changement de plan, ainsi qu’un certificat d’assurance avec vos nouvelles prestations.

Quelques explications en images

Les trois critères de la pénibilité physique fixés dans la LCPEG (art. 23) sont :

- la sollicitation physique,

- les influences environnementales (bruit, odeurs, variations de température, etc.)

- les horaires irréguliers.

Le Conseil d’Etat a adopté en juin 2013 un Règlement d’application de l’art. 23 de la LCPEG (pénibilité), qui donne la liste exhaustive des activités concernées. Précisons que la pénibilité physique ne peut être reconnue que pour des fonctions listées dans le règlement du CE et rémunérées dans une classe de fonction ne dépassant pas la classe 17. Toute question à ce sujet doit être adressée à votre employeur, qui est responsable de l’application de ce règlement.

En général

Le rachat est un versement volontaire qui vous permet de combler les éventuelles lacunes de vos prestations de prévoyance professionnelle. Il existe en effet une lacune de prévoyance si la date de l’origine de vos droits ne correspond pas à vos 20 ans et/ou si votre taux moyen d’activité (TMA) est inférieur à votre taux d’activité en cours.

A la CPEG, le rachat vous permet de compléter tout ou partie des années d’assurance jusqu’à 20 ans et/ou de faire augmenter votre TMA jusqu’à concurrence de votre taux d’activité actuel.

Quelques explications en images

- La totalité du rachat est déductible fiscalement.

- Le coût de rachat d’une année d’assurance augmente avec l’âge. Racheter des années tôt dans votre carrière est plus avantageux.

- Si vous avez bénéficié d’un retrait dans le cadre de l’encouragement à la propriété du logement (EPL), vous devez rembourser le montant du retrait avant de pouvoir effectuer un rachat. L’avantage fiscal dans ce cas se limite à la récupération de l’impôt payé lors du retrait.

- Vous pouvez, suite à un divorce, procéder à un remboursement pour corriger la diminution de votre avoir accumulé. Ce remboursement est similaire à un rachat, mais peut dans ce cas être effectué indépendamment de l’existence d’un retrait EPL. Un tel remboursement est déductible fiscalement.

- Si vous arrivez de l’étranger, le rachat est limité pendant les 5 premières années à 20% du traitement cotisant tel qu’indiqué sur votre certificat d’assurance.

- Si vous avez un 3e pilier lié (3a), vous devez joindre au formulaire de demande de rachat un décompte de vos avoirs 3a.

- Si vous disposez d’un avoir de libre passage (compte bloqué auprès d’une banque ou police de libre passage auprès d’une compagnie d’assurance), vous devez nous en annoncer le montant, qui sera déduit du montant maximal de la somme de rachat.

- Pendant la durée d’un arrêt de travail (maladie ou accident), le rachat n’est pas possible.

- Le rachat peut s’effectuer au comptant jusqu’à l’âge d’entrée en retraite ou par mensualités jusqu’à 58 ans révolus. Signalons que, s’il subsiste un EPL en cours à l’âge de 62 ans, aucun rachat ne sera plus autorisé jusqu’à l’âge de la retraite (voir les précisions pour l’EPL).

- Si vous percevez ou avez perçu des prestations de vieillesse et que vous reprenez une activité lucrative ou augmentez à nouveau votre taux d’activité, le montant maximal de la somme de rachat est diminué du montant des prestations de vieillesse que vous avez déjà perçues.

- Vous remplissez le formulaire « Demande de rachat d’assurance » accessible ci-dessous, sans oublier d’informer la Caisse de vos avoirs de libre passage et du pilier 3a.

- Dans le mois qui suit, la Caisse vous enverra une offre de rachat, comprenant l’impact de celui-ci sur vos rentes.

- En cas d’accord, vous retournez l’offre datée et signée à la Caisse.

- En cas de montant dépassant 2 fois la rente AVS maximale (soit 57’360 CHF en 2021), vous devrez remplir un questionnaire de santé transmis par la Caisse et prendre rendez-vous avec notre médecin-conseil dans un délai de 30 jours. Ce contrôle permet d’éviter un rachat dans le but d’améliorer les prestations d’invalidité et de décès alors que l’assuré·e aurait pleinement conscience ne pas disposer de sa pleine capacité de travail. Cette condition ne s’applique pas si vous effectuez ce rachat suite à un divorce.

En général

L’encouragement à la propriété du logement (EPL) vous permet d’utiliser tout ou partie de votre avoir de prévoyance pour acquérir ou construire un bien immobilier, rembourser un prêt hypothécaire, acquérir des participations à la propriété d’un logement ou effectuer des travaux d’importance et de nature exceptionnelle.

Vous avez le choix entre un versement anticipé de votre prestation de libre passage (PLP) ou sa mise en gage.

Le logement que vous financez grâce à votre EPL doit être utilisé pour vos propres besoins, c’est-à-dire que vous devez l’habiter vous-même (que ce soit en Suisse ou à l’étranger). Votre avoir de prévoyance ne peut financer qu’un seul logement à la fois qui doit correspondre à votre logement principal. Ainsi, l’acquisition d’une résidence secondaire au moyen du 2e pilier est exclue.

Quelques explications en images

- Si vous avez moins de 50 ans, vous pouvez disposer de la totalité de votre PLP (telle qu’indiquée dans votre certificat d’assurance)

- Si vous avez 50 ans et plus, vous pouvez disposer de la PLP acquise à 50 ans ou de la moitié de la PLP au moment du retrait.

- Le retrait minimal est de CHF 20’000.-, sauf pour les acquisitions de parts sociales, pour lesquelles il n’y a pas de minimum.

- Pour tout retrait EPL, l’accord signé de votre conjoint·e ou de votre partenaire enregistré·e est obligatoire.

- Un versement EPL nécessite le paiement de frais de dossier (CHF 500.-).

- Sauf exceptions légales, les demandes de versements anticipés sont traitées dans les 6 mois qui suivent le dépôt du dossier complet.

- Un versement anticipé entraîne une diminution de toutes vos prestations assurées (retraite, invalidité, décès).

- Le montant du retrait est soumis à imposition. Si vous êtes en Suisse, vous percevrez le montant brut et devrez payer l’impôt correspondant avec vos fonds propres. Si vous êtes à l’étranger, vous percevrez le montant net d’impôt, celui-ci étant prélevé à la source.

Remboursement de l’EPL

- Le remboursement de l’EPL est obligatoire en cas de vente, de location ou d’usufruit du bien concerné.

- Le remboursement de l’EPL est obligatoire en cas de rachat de cotisation (sauf s’il s’agit d’un rachat effectué suite à un divorce pour corriger la diminution de votre avoir accumulé).

- Vous avez la possibilité de rembourser tout ou partie de vos retraits EPL jusqu’à l’âge de 65 ans.

Déroulement type d’une demande EPL :

- Vous remplissez le formulaire de demande EPL accessible ci-dessous, vous l’imprimez et vous l’envoyez par courrier à la CPEG.

- La CPEG vous envoie un courrier ad hoc, mentionnant les documents à fournir et/ou les démarches à effectuer. Vous recevrez également une information sur l’impact que votre retrait anticipé aura sur vos prestations.

- Vous envoyez les documents et justificatifs demandés.

- Une fois le dossier complété, vous devez signer, le cas échéant avec votre conjoint·e ou partenaire enregistré·e, la confirmation du retrait et ses impacts sur les prestations.

- La CPEG effectue le versement soit auprès de la ou du notaire, d’une banque ou d’une coopérative en fonction du type d’achat. Le versement ne peut en aucun cas se faire sur votre compte personnel.

- Si vous souhaitez plus tard rembourser tout ou partie de ce retrait, nous vous recommandons de prendre contact avec notre division Assurance. Un tel remboursement doit être au minimum de CHF 10’000 et l’impôt perçu lors du retrait est alors récupéré proportionnellement au montant remboursé.

- Si vous souhaitez plus de détails sur les conditions de prêts hypothécaires, voir ci-dessous.

FAQ

La mise en gage n’entraîne pas de réduction des prestations de prévoyance et n’est pas soumise au versement d’un impôt. En cas de réalisation du gage, le montant est traité comme un versement anticipé. A noter que les deux possibilités peuvent être combinées.

L’acquisition d’un bien immobilier est à considérer comme une forme de prévoyance.

Par conséquent, au moment du financement de votre logement situé en Suisse, une restriction du droit d’aliéner est mentionnée au Registre foncier. Les frais d’inscription sont à votre charge.

Cette inscription permet la garantie du but de prévoyance. En cas de vente de votre logement, la Caisse en sera informée et vous demandera de rembourser le montant versé.

Si le bien que vous souhaitez acquérir se situe à l’étranger, en cas de revente de celui-ci vous êtes également tenu de rembourser à l’institution le montant de votre prévoyance qui a été versé.

Vous devez préalablement apporter la preuve que vous êtes propriétaire de votre logement. La Caisse détermine, selon la liste OFAS, si les travaux envisagés peuvent être admis. Seuls les travaux de rénovation ou de transformation qui apportent un maintien de qualité ou une plus value au bien immobilier sont autorisés.

En revanche, sont exclus : les aménagements extérieurs (piscine, garage, portail, clôture etc..) et les travaux intérieurs de simple entretien (peintures, papiers peints, moquettes, appareils ménagers, etc.).

La CPEG a la possibilité d’octroyer à ses membres, pour le financement d’une résidence primaire ou secondaire, des prêts hypothécaires à taux variable ou à taux fixe (sur des durées comprises entre 2 et 15 ans). Des calculateurs de prêt hypothécaire sont à votre disposition pour vous donner une première indication.

Documents

En général

Le certificat de prévoyance est une sorte de relevé de compte qui permet aux membres salarié·es de connaître les prestations auxquelles elles et ils peuvent avoir droit dans le cadre de leur 2e pilier. Il est envoyé une fois par année.

Vous trouverez ci-dessous les explications correspondant aux différentes rubriques.

Ces données sont transmises par votre employeur. En cas d’inexactitude, il faut vous adresser à ce dernier pour qu’il les modifie.

| Votre âge en ans et mois | Votre âge est calculé à la date d’émission du certificat telle qu’indiquée en entête. |

| Date d’affiliation | Votre date d’affiliation correspond à votre première entrée dans la Caisse ou dans l’une des deux anciennes caisses fusionnées à la CPEG. |

| Clause bénéficiaire / Communauté de vie | Si vous nous avez transmis une Clause bénéficiaire et/ou une Communauté de vie et que ces documents sont toujours valides, la date de dépôt de ces documents est indiquée dans cette rubrique. |

Un certificat d’assurance est émis pour chaque activité. Ces données sont transmises par votre employeur. En cas d’inexactitude, il faut vous adresser à ce dernier pour qu’il les modifie.

| Employeur | Ces données correspondent à votre activité auprès d’un employeur donné, servant de base au présent certificat. |

| Groupe professionnel | Le groupe professionnel détermine vos droits électoraux à l’assemblée des délégué·es et au comité. A : Enseignement ; B : Administration ; C : Etablissements publics médicaux. |

| Pénibilité physique | Une activité reconnue comme physiquement pénible vous permet de bénéficier d’une rente de retraite non réduite dès l’âge de 62 ans au lieu de 65 ans dans le cas contraire. Les activités physiquement pénibles sont énumérées dans le Règlement d’application de l’article 23 de la loi instituant la CPEG. Votre employeur est responsable de l’application de ce Règlement. |

Ces données sont transmises par votre employeur. En cas d’inexactitude, il faut vous adresser à ce dernier pour qu’il les modifie.

| Traitement déterminant | Le traitement déterminant correspond à votre traitement légal annuel, compte tenu de votre taux d’activité contractuel. |

| Traitement cotisant | Le traitement cotisant, qui sert au calcul des cotisations, correspond au traitement déterminant moins une déduction de coordination avec l’assurance fédérale vieillesse et survivants (AVS). |

| Taux de cotisation | Le taux de cotisation de 9% appliqué au traitement cotisant correspond à votre financement retenu sur votre salaire. Le taux de cotisation de 18% appliqué au traitement cotisant correspond au montant financé par votre employeur. |

| Date d’origine des droits | La date d’origine des droits correspond à la date à compter de laquelle la durée d’assurance dans le plan de prévoyance CPEG est calculée. Cette date correspond à votre date d’affiliation. Elle est toutefois adaptée en fonction de vos apports (date reculée dans le temps) ou de vos retraits (date avancée dans le temps). |

| Durée d’assurance acquise | La durée d’assurance acquise correspond à la durée comprise entre la date d’origine des droits et la date d’émission du certificat. Elle permet de calculer votre prestation de sortie et vos prestations de retraite. |

| Traitement assuré | Le traitement assuré, qui sert au calcul des prestations, correspond au dernier traitement cotisant à 100% pondéré par votre taux moyen d’activité. |

| Taux moyen d’activité (TMA) | Le taux moyen d’activité (TMA) correspond à la moyenne arithmétique de tous vos taux d’activité effectifs mensuels depuis votre date d’origine des droits jusqu’à la date d’émission du certificat. |

| Age de référence réglementaire | L’âge de référence réglementaire correspond à l’âge à partir duquel la rente de retraite est calculée sans facteur de minoration pour départ en retraite anticipée. Il est de 62 ans en cas d’activité reconnue comme physiquement pénible et de 65 ans dans les autres cas. |

| Prestation de sortie | La prestation de sortie CPEG correspond au montant qui serait transmis à votre nouvelle institution de prévoyance en cas de changement d’employeur non affilié à la CPEG.

Ce montant doit toujours être supérieur ou égal à l’avoir de vieillesse LPP calculé selon les règles minimales définies dans la loi sur la prévoyance professionnelle. |

| 58 ans | Vous avez droit à une rente de retraite dès l’âge de 58 ans. |

| Date de la 1re rente | La date à partir de laquelle la 1re rente est due correspond au 1er du mois qui suit le mois de votre départ. |

| Taux moyen d’activité (TMA) | Le taux moyen d’activité (TMA) projeté prend en compte pour la projection le taux d’activité contractuel en vigueur à la date d’émission du certificat. |

| Rente de retraite | La rente de retraite est calculée en tenant compte pour le futur de vos données salariales en vigueur à la date d’émission du certificat. Elle est donc sujette à évoluer selon l’évolution de vos données salariales. |

| Rente d’enfant | Une rente d’enfant calculée selon les règles minimales définies dans la loi sur la prévoyance professionnelle sera versée complémentairement à la rente de retraite dès l’âge de référence réglementaire et ce jusqu’au 20 ans révolus de chaque enfant né avant le départ en retraite, âge reporté jusqu’à 25 ans en cas de formation. |

| Rente d’invalidité | La rente d’invalidité indiquée est prévue pour une invalidité reconnue à 70% au moins par l’assurance-invalidité (AI). Elle correspond à la rente de retraite projetée à 65 ans. |

| Rente d’enfant d’invalide | Une rente d’enfant d’invalide s’élevant à 20% de la rente d’invalidité vous serait également versée complémentairement pour chaque enfant jusqu’à ses 20 ans révolus, âge reporté jusqu’à 25 ans en cas de formation. |

| Rente de conjoint·e survivant·e | En cas de décès, votre conjoint·e ou votre partenaire enregistré·e (selon la loi fédérale) aurait droit à une rente de conjoint·e survivant·e qui s’élèverait à 60% de la rente d’invalidité. |

| Rente d’orphelin·e | Une rente d’orphelin·e correspondant à 20% de la rente d’invalidité serait également versée à chaque enfant jusqu’à ses 20 ans révolus, âge reporté jusque 25 ans en cas de formation. |

| Cotisation de base | Votre cotisation de base prélevée mensuellement sur votre salaire correspond à 9% de votre traitement cotisant annuel divisé par douze. |

| Autres cotisations | Vos autres cotisations listent les retenues mensuelles toujours en cours sur votre salaire qui servent à financer:

|

| Cotisation de base | La cotisation de base versée mensuellement par votre employeur correspond à 18% de votre traitement cotisant annuel divisé par douze. |

| Autres cotisations | Les autres cotisations listent les versements mensuels effectués par votre employeur pour financer des rachats ou des rappels de cotisations auxquels il participe et dont l’amortissement du coût présente un solde ouvert à la date d’émission du certificat. |

| Montant disponible | Le montant disponible représente le montant maximal que vous avez la possibilité de retirer pour l’achat de votre résidence principale. |

| Solde de vos retraits | Si vous avez déjà effectué un tel retrait, le solde vous indique le montant que vous pouvez rembourser pour améliorer vos prestations. |

Cette rubrique vous indique le montant maximal que vous devriez verser à la date d’émission du certificat pour obtenir la rente mensuelle de retraite maximale à laquelle vous pourriez prétendre.

FAQ

Une correction de cotisation a pour but de régulariser un solde de cotisation existant. Elle peut apparaître dans différents cas :

- En début d’année si un solde de cotisation existe au 31.12 de l’année précédente. En principe, ce solde est traité en 12e sur l’année en cours.

- En cas de sortie de la CPEG (si un solde de cotisation existe à ce moment-là).

- Lorsqu’un accord de régularisation est intervenu entre l’assuré et la CPEG.

Le montant de la correction de cotisation est porté en déduction de la cotisation de base si le solde à régulariser est en faveur de l’assuré·e et est ajouté à celle-ci en cas de solde en faveur de la CPEG.

Les trois critères de la pénibilité physique fixés dans la LCPEG (art. 23) sont :

- la sollicitation physique,

- les influences environnementales (bruit, odeurs, variations de température, etc.)

- les horaires irréguliers.

Le Conseil d’Etat a adopté en juin 2013 un Règlement d’application de l’art. 23 de la LCPEG (pénibilité), qui donne la liste exhaustive des activités concernées. Précisons que la pénibilité physique ne peut être reconnue que pour des fonctions listées dans le règlement du CE et rémunérées dans une classe de fonction ne dépassant pas la classe 17. Toute question à ce sujet doit être adressée à votre employeur, qui est responsable de l’application de ce règlement.

Documents

En général

Le Règlement général de la CPEG définit l’invalidité comme « une atteinte durable à la santé physique ou mentale […] entraînant une incapacité partielle ou totale de remplir sa fonction ».

Si votre invalidité est reconnue par l’assurance-invalidité (AI), vous avez droit à une pension d’invalidité de la part de la Caisse, qui se basera sur les décisions de l’AI pour définir votre droit aux prestations.

Si l’AI tarde à rendre sa décision sur le degré d’invalidité, la Caisse peut verser des prestations provisoires équivalant à la pension d’invalidité.

Quelques explications en images

Voici les principaux éléments à retenir concernant l’invalidité.

Montant de la rente

- La pension d’invalidité est égale à la pension de retraite projetée à l’âge de 65 ans, multipliée par le degré de l’invalidité. Pour les personnes exerçant une activité à pénibilité physique, la pension est calculée sans facteur actuariel de majoration.

- La Caisse ne versera de rente d’invalidité que s’il y a reconnaissance de votre invalidité par l’AI. La rente ne sera versée qu’à partir du mois où vous ne percevrez plus votre salaire.

Invalidité provisoire

- Si la fin de votre droit au salaire intervient avant la décision de l’AI, la Caisse peut vous octroyer une rente d’invalidité provisoire si vous avez, conjointement avec votre employeur, déposé une telle demande.

- La rente provisoire est calculée sur la base de l’avis de notre médecin-conseil.

- La Caisse ne verse pas de prestations provisoires si l’AI vous verse des indemnités journalières.

- Si la décision de l’AI est négative, les prestations provisoires vous restent acquises.

Invalidité définitive

- Si la décision de l’AI est positive, la rente d’invalidité est due rétroactivement depuis la date de reconnaissance de l’invalidité. Pour la période durant laquelle vous avez perçu des rentes d’invalidité provisoires, celles-ci sont récupérées par la Caisse au prorata de la rente d’invalidité calculée conformément à l’AI.

- Si vous êtes au bénéfice d’une pension d’invalidité, vous avez droit à une pension d’enfant d’invalide pour chacun·e de vos enfants âgé·es de moins de 20 ans, ou de moins de 25 ans si elles ou ils poursuivent des études ou un apprentissage. La pension correspond à 20% de votre rente d’invalidité. Précisons que ces pensions d’enfants d’invalide n’existent pas pour la rente d’invalidité provisoire.

Surassurance

- Le montant des versements additionnés (notamment AI + assurance accident + CPEG) est plafonné à 90% de votre salaire AVS.

Voici le déroulement d’une procédure type :

- Vous déposez une demande d’invalidité auprès de l’AI.

- S’il existe un risque que l’AI ne rende sa décision qu’après la fin de votre droit au salaire, vous pouvez, conjointement avec votre employeur faire une demande de prestations provisoires d’invalidité auprès de la Caisse, signée par les deux parties. Vous trouverez ci-dessous le formulaire de demande, à envoyer 4 mois au plus tard avant la fin du droit au salaire, afin d’éviter tout report du versement de la prestation provisoire.

- La Caisse complète si nécessaire avec vous les données de votre dossier, puis le transmet à la ou au médecin-conseil de la Caisse.

- Notre médecin-conseil nous rend son préavis, après consultation de votre médecin traitant·e et de la ou du médecin-conseil de votre employeur, en indiquant le taux d’invalidité reconnu provisoirement.

- Si ce préavis est positif, la Caisse ouvre les prestations provisoires à la fin de votre droit au salaire ou des indemnités qui en tiennent lieu, dans l’attente de la décision de l’AI. Si le préavis de l’AI nous est notifié avant le préavis de notre médecin-conseil, les prestations provisoires peuvent aussi être ouvertes. Le degré d’invalidité retenu pour le versement des prestations provisoires d’invalidité est alors celui fixé dans le préavis de l’AI.

- Si la décision définitive de l’AI est positive, les prestations provisoires versées par la CPEG sont remplacées par notre pension d’invalidité. La Caisse établit un décompte entre les rentes d’invalidité dues rétroactivement et les rentes d’invalidité provisoires déjà versées pour la même période. Si l’AI révise ultérieurement sa décision, la CPEG adapte en conséquence sa prestation.

- Si la décision de l’AI est négative, les prestations provisoires versées par la CPEG prennent fin (à la date de réception de cette décision, à moins qu’elles n’aient déjà pris fin à la date du préavis négatif de l’AI). Si l’AI vous refuse une rente d’invalidité ou vous octroie une rente partielle ou inférieure au minimum requis, vous pouvez, conjointement avec votre employeur, adresser à la Caisse une demande d’invalidité réglementaire (voir article 34 du RCPEG).

En général

En cas de décès d’un·e membre salarié·e, la CPEG verse, sous certaines conditions, une rente à sa ou son conjoint·e ou partenaire survivant·e, à son ou ses orphelin·es et à sa ou son conjoint·e survivant·e divorcé·e.

En l’absence de conjoint·e ou partenaire survivant·e, un capital décès est versé aux héritières et héritiers reconnu·es au sens de la LPP ou tel·les que défini·es dans une clause bénéficiaire à remplir par vos soins (voir ci-dessous Documents).

La rente de conjoint·e ou partenaire survivant·e, telle qu’indiquée sur le certificat d’assurance, correspond à 60% de la rente d’invalidité.

Pour pouvoir bénéficier d’une telle rente, la ou le conjoint·e ou partenaire enregistré·e au sens de la loi fédérale sur le partenariat doit respecter une des conditions suivantes :

- avoir 40 ans révolus ou

- être invalide au sens de l’AI ou

- avoir à charge un·e ou plusieurs enfants ayant droit à une pension d’orphelin·e.

Au cas où le conjoint·e survivant·e ne remplit aucune de ces trois conditions, elle ou il touche une indemnité unique égale à 3 pensions annuelles, mais au minimum le capital décès réglementaire.

Quelques explications en images

Le droit à la rente de conjoint·e survivant·e prend naissance le 1er jour du mois qui suit le décès; il s’éteint par le remariage ou le décès de la ou du conjoint·e.

Au décès d’un·e membre salarié·e, chacun·e de ses enfants a droit à une pension d’orphelin·e (20% de la rente d’invalidité). Il en va de même des enfants en voie d’adoption ou de celles et ceux recueilli·es lorsque la ou le membre défunt·e était tenu·e de pourvoir à leur entretien. Ce droit prend naissance le jour où le traitement de la ou du membre défunt·e cesse d’être payé; il s’éteint par l’accomplissement de la vingtième année (âge reporté à 25 ans révolus en cas d’études ou d’apprentissage) ou le décès de l’orphelin·e.

S’il n’y a pas de rente de conjoint·e survivant·e, la rente des orphelin·es est doublée.

S’il n’y a pas de conjoint·e survivant·e, un capital décès est versé aux bénéficiaires défini·es ci-dessous dans En savoir plus sur le capital décès et la clause bénéficiaire. Le capital est égal aux versements effectués par la ou le membre défunt·e, sans intérêts. A défaut de bénéficiaires, le capital décès reste acquis à la Caisse.

Les partenaires qui ne sont ni marié·es ni enregistré·es au sens de la Loi fédérale sur le partenariat ne peuvent pas bénéficier d’une rente de partenaire survivant·e. Elles ou ils peuvent avoir droit au capital décès à la condition que vous ayez retourné à la Caisse l’attestation de communauté de vie (voir ci-dessous Documents). Les pensions sont ajoutées aux autres revenus de la ou du bénéficiaire et imposées entièrement. Si la ou le bénéficiaire est domicilié·e à l’étranger, elle ou il peut, selon les circonstances, être imposé·e à la source par la Caisse.

- En cas de décès d’un·e membre salarié·e, sa famille proche ou son employeur avise la Caisse.

- La Caisse récolte les informations nécessaires, contrôle les conditions d’octroi et verse, selon les cas, les rentes ou le capital-décès aux bénéficiaires reconnu·es.

Les bénéficiaires du capital décès sont les suivants :

- enfants qui remplissent les conditions de l’art. 28 RCPEG (≤ 20 ans sans condition, puis entre 20 et 25 ans si en formation) et/ou personnes à charge de la ou du défunt·e et/ou personne qui a formé avec la ou le défunt·e une communauté de vie ininterrompue d’au moins 5 ans immédiatement avant le décès (sur remise d’une convention de communauté de vie à la Caisse) ou personne qui a formé avec la ou le défunt·e une communauté de vie immédiatement avant le décès (sans condition de durée) et qui doit subvenir à l’entretien d’un·e ou de plusieurs enfants commun·es (sur remise d’une convention de communauté de vie à la Caisse) ;

- à défaut des bénéficiaires prévu·es sous 1 : les enfants qui ne remplissent pas les conditions de l’art. 28 RCPEG, à défaut les parents, à défaut les frères et sœurs de la ou du défunt·e ;

- à défaut des bénéficiaires prévu·es sous 1 et 2 : les autres héritières légales et héritiers légaux à l’exclusion des collectivités publiques.

Clause bénéficiaire

Vous pouvez prévoir, par une clause bénéficiaire communiquée de votre vivant à la Caisse, un ordre ou une clé de répartition entre les divers·es bénéficiaires d’une même catégorie – sans oublier de remplir le cas échéant la convention attestant de la communauté de vie avec votre partenaire si vous n’êtes ni marié·es ni enregistré·es au sens de la Loi fédérale (voir ci-dessous Documents).

Nous vous invitons à mettre à jour régulièrement votre clause bénéficiaire et/ou votre convention attestant de la communauté de vie. Cette mise à jour est essentielle en cas de changement dans votre situation de vie, notamment dans les hypothèses suivantes:

- S’agissant de la convention attestant de la communauté de vie : en cas de fin de la communauté de vie. Celle-ci doit nous être communiquée par écrit.

- S’agissant de la clause bénéficiaire :

- En cas de changement de volonté de votre part ;

- En cas de décès d’une ou de plusieurs personne·s bénéficiaire·s désignée·s dans la clause bénéficiaire ;

- En cas de révocation ou de remise d’une nouvelle convention attestant de la communauté de vie à la Caisse ;

- Lorsqu’une personne désignée dans la clause bénéficiaire ne remplit plus les conditions de la catégorie dans laquelle elle a été inscrite (par exemple enfant de plus de 25 ans).

Pour mettre à jour la clause bénéficiaire, nous vous remercions de remplir un nouveau formulaire de clause bénéficiaire et de nous l’envoyer. Ce nouveau document, pour autant qu’il soit valablement rempli, annule et remplace le précédent (voir ci-dessous Documents).

Nous attirons votre attention sur le fait que la LPP ne prend pas en compte le droit successoral (par exemple un testament). Seule la clause bénéficiaire fera foi dans le cas de la répartition d’un capital décès éventuel.

FAQ

En revanche, les partenaires hétérosexuels non mariés, même au bénéfice d’un partenariat cantonal ou d’un autre pays, ne peuvent pas bénéficier d’une rente de partenaire survivant. Ils peuvent toutefois avoir droit, à certaines conditions, au capital décès (art. 30 RCPEG). Si vous souhaitez en faire bénéficier votre partenaire, il est impératif que vous remplissiez la clause bénéficiaire ainsi que l’attestation de communauté de vie (d’au moins 5 ans avant le décès). Vous trouverez ces documents ci-dessous et nous nous tenons à votre disposition pour toute question à ce sujet.

Vous trouverez de plus amples informations sur sur le partenariat enregistré fédéral en suivant ce lien.

Si la personne survivante est plus jeune que la personne défunte, la pension est réduite de 1% par année ou fraction d’année dépassant 10 ans de différence d’âge. Cette réduction s’élève au maximum à 50%. Aucune réduction n’est opérée si un·e enfant, ayant droit à la pension d’orphelin·e, est à charge de la ou ou du conjoint·e survivant·e.

En général

Si vous quittez votre emploi avant 58 ans, votre assurance à la Caisse prend fin et vous avez droit à une prestation de sortie, sauf si votre nouvel employeur est aussi affilié à la CPEG (dans ce cas, voir sous Situation professionnelle).

Vous devrez transmettre à la Caisse les instructions permettant à cette dernière d’effectuer le transfert de votre prestation de sortie.

A défaut d’instructions de votre part dans un délai de 6 mois, la Caisse transférera automatiquement votre prestation de sortie auprès de la Fondation institution supplétive LPP.

A défaut d’une affiliation immédiate auprès d’une nouvelle caisse de pension, vous restez couvert·e pour les risques invalidité et décès auprès de la CPEG durant les 30 jours qui suivent votre départ. Vous devez verser votre prestation de sortie sur un compte bloqué ou une police d’assurance auprès d’une institution de libre passage, afin que votre prévoyance professionnelle soit maintenue.

Si vous avez plus de 58 ans au moment du départ, vous avez droit à une prestation de retraite. Toutefois, si vous continuez d’exercer une activité lucrative (dépendante ou indépendante) ou vous vous inscrivez à l’assurance-chômage, vous pouvez remplacer la prestation de retraite par la prestation de sortie correspondante.

En cas de résiliation après 55 ans des rapports de services par votre employeur ou à la suite d’un commun accord et que vous restez assujetti·e à l’AVS, vous avez la possibilité de rester assuré∙e auprès de la CPEG en continuant de bénéficier quasiment des mêmes droits (voir ci-dessous « Est-il possible de maintenir ma prévoyance en cas de licenciement après 55 ans? »).

Vous pouvez obtenir le versement en espèces de la totalité de votre prestation de sortie (si vous êtes marié·e, séparé·e ou lié·e par un partenariat enregistré, l’accord écrit de votre conjoint·e ou partenaire est nécessaire) dans l’un des cas suivants :

- Vous quittez définitivement la Suisse. Si le pays de destination se trouve dans l’UE ou dans l’AELE, vous devrez en outre apporter la preuve que vous n’êtes pas obligatoirement affilié·e au régime de sécurité sociale de ce pays. A défaut de cette preuve, le montant sera limité à la part surobligatoire (soit la part excédant l’avoir de vieillesse LPP, indiqué comme tel sur votre certificat d’assurance). Dans ce cas, la part obligatoire (l’avoir de vieillesse LPP) sera bloquée sur un compte dans l’établissement de votre choix. Seule la partie faisant l’objet d’un versement en espèces sera imposée à la source au barème de l’administration fiscale. Selon le pays où vous avez élu domicile et selon les conventions de double imposition, vous avez la possibilité de demander la restitution de cette imposition dans un délai de 3 ans.

- Vous vous établissez à votre compte et n’êtes plus soumis·e à la prévoyance professionnelle obligatoire (le justificatif du statut d’indépendant·e est fourni par votre caisse de compensation AVS).

- Votre prestation de sortie représente un montant négligeable (inférieur au montant annuel de vos cotisations personnelles).

Si vous récupérez un rachat sous forme de capital dans un délai de moins de 3 ans, les autorités fiscales pourraient revoir la déductibilité fiscale accordée lors du rachat. Pour éviter ce risque, vous pouvez transférer le montant en question sur un compte bloqué le temps que ce délai soit écoulé.

Voici le déroulement d’une sortie type:

- Votre employeur communique à la Caisse la date de la fin de vos rapports de service.

- La CPEG vous envoie un courrier de sortie, accompagné d’un formulaire listant les différents cas possibles. Si vous avez un nouveau contrat auprès d’un employeur affilié à la CPEG, vous n’avez rien à faire (pour autant que le délai entre l’ancien et le nouveau contrat ne dépasse pas 6 mois); le transfert de votre prestation de sortie se fera en interne sur la base de votre nouvelle activité annoncée par votre nouvel employeur.

- Vous remplissez le formulaire en choisissant l’option correspondant à votre situation personnelle (transfert de votre prestation de sortie auprès d’une nouvelle caisse de pension, d’une banque ou d’une assurance ou versement en espèce) et le renvoyez à la Caisse dans un délai de 6 mois.

- La CPEG exécute les instructions reçues de votre part. A défaut de réponse dans un délai de 6 mois, la CPEG transfèrera la prestation de sortie auprès de la Fondation institution supplétive LPP et vous en informe.

- Dès le versement effectué, vous recevrez un décompte de sortie mentionnant le montant et les intérêts éventuels.

- Dans le cas où votre employeur met fin à vos rapports de service après vos 55ans et que vous souhaitez maintenir votre prévoyance auprès de la CPEG, voir ci-dessous.

En cas de résiliation des rapports de service après l’âge de 55 ans par votre employeur ou à la suite d’un commun accord, et que vous restez assujetti·e à l’AVS, vous avez la possibilité de rester assuré∙e auprès de la CPEG en continuant de bénéficier quasiment des mêmes droits.

Ce choix permet de continuer d’améliorer vos prestations, soit uniquement pour les risques d’invalidité et de décès, soit pour les risques et la retraite.

Les cotisations (part employé∙e et part employeur) seront totalement à votre charge et s’élèveront à 3% en cas de maintien des risques seuls et à 27% en choisissant de continuer de cotiser aussi pour la retraite.

Quelques points à noter:

- L’assurance peut porter sur l’intégralité de l’ancien traitement déterminant, les deux tiers ou le tiers de ce dernier.

- Le maintien de l’assurance prend effet le 1er du mois suivant celui de la fin des rapports de service.

- Les cotisations correspondant à la couverture choisie sont dues mensuellement en début de mois. La première fois pour le 1er du mois qui suit celui de la fin des rapports de service.

- La couverture choisie est ferme pour une période de 6 mois. Au-delà, le niveau de couverture peut être modifié, au maximum 2 fois par an.

- La couverture peut être résiliée en tout temps, soit en cas de nouvel emploi entraînant le transfert de la prestation de libre passage dans la nouvelle institution de prévoyance, soit volontairement par l’assuré·e avec un préavis de 60 jours. Dans ce second cas, la rente sera calculée selon les paramètres applicables à la date de résiliation (durée d’assurance, âge, etc.).

Le montant de la prestation de libre passage (PLP) correspond au montant le plus élevé entre :

- la prestation de libre passage selon nos statuts et conformément à l’article 16 de la loi fédérale sur le libre passage (LFLP)

- le montant minimum défini à l’article 17 LFLP

- l’avoir de vieillesse défini à l’article 18 LFLP

Les règles de calcul sont complexes. Pour une information personnalisée, nous vous prions de vous adresser directement à la division Assurance, service des Assurés. Par ailleurs, nous vous précisons que le montant de votre prestation de libre passage figure dans votre certificat d’assurance.

La Confédération a publié sur le libre-passage un guide (en neuf langues) : Prestations de libre passage : n’oubliez pas vos avoirs de prévoyance!

Documents

En cas de résiliation des rapports de service après l’âge de 55 ans par votre employeur ou à la suite d’un commun accord, vous pouvez faire une demande de maintien des prestations.

En général

Vous pouvez commencer votre retraite entre 58 et 65 ans (et dans certains cas 70 ans). Différentes options vous sont proposées (pour plus de détails, voir Prestations de retraite) :

- Retraite l’âge de référence réglementaire

- Retraite partielle

- Retraite anticipée

- Capital retraite

Un simulateur est à votre disposition pour calculer votre pension.

Quelques explications en images

- Avant de prendre votre retraite, vous pouvez participer aux séances de préparation à la retraite organisées par votre employeur ou contacter votre gestionnaire afin de prendre connaissance de la palette des prestations.

- Si vous continuez d’exercer une activité lucrative (dépendante ou indépendante) ou si vous vous inscrivez à l’assurance-chômage, vous pouvez remplacer la prestation de retraite par la prestation de sortie correspondante. Dans ce cas, vous avez 30 jours pour en informer la Caisse. A défaut, le choix de la rente sera irrévocable.

- Dès 65 ans pour le plan standard (62 ans avec le plan pénibilité), vous pouvez bénéficier comme membre retraité·e de rentes d’enfants (de 20 ans, ou de moins de 25 ans si elles et ils poursuivent des études ou un apprentissage). Attention, c’est à vous d’initier cette demande. Les enfants qui donnent droit à une pension complémentaire doivent être né·es avant votre départ à la retraite.

- Si un solde de cotisation reste dû (par exemple rappel de cotisations par mensualités financières), ce montant sera soldé par prélèvement sur votre pension de retraite.

- Les rentes et capitaux sont versés le dernier jour ouvrable de chaque mois. En cas de retour tardif des informations nécessaires au paiement de votre première rente, celle-ci ne pourra être versée que le mois suivant.

- Tous les deux ans, la CPEG contrôle vos conditions d’octroi, afin de ne pas verser des rentes à tort (voir chapitre Enquête de vie).

- Dorénavant, vous avez l’obligation d’informer la Caisse de tout changement concernant votre situation personnelle (voir chapitre Evénements dans la situation personnelle d’un∙e membre bénéficiaire de pension).

Déroulement d’un départ à la retraite type:

- Conjointement avec votre employeur, vous fixez la date de votre départ en retraite.

- Le mois précédant votre entrée en retraite, votre employeur l’annonce à la CPEG.

- Quelques jours avant votre entrée en retraite, la CPEG vous envoie un courrier avec un formulaire.

- Vous devez remplir le formulaire et le renvoyer avec les annexes demandées à la CPEG au plus tard le 20 du premier mois de votre retraite pour pouvoir bénéficier du versement de votre rente dans le courant de ce premier mois.

- La CPEG vous verse les prestations dues en fin de mois, puis vous envoie le certificat de pension.

- En février de chaque année, la CPEG vous envoie une attestation fiscale vous permettant de déclarer les rentes perçues l’année précédente.

L’âge de retraite de l’ensemble du personnel de l’Etat de Genève est fixé à 65 ans selon la loi sur le personnel (B 5 05, art. 25, al. 1)

La CPEG a donc un âge de référence réglementaire en cohérence avec l’âge légal de retraite de l’Etat de Genève (soit 65 ans indifféremment pour les femmes et les hommes).

La conformité avec le droit fédéral se fait au niveau du montant des prestations. A titre d’exemple, si une assurée prend sa retraite anticipée avant 65 ans, il faut s’assurer que sa rente, après minoration de 5% pour anticipation, est supérieure à la rente minimale LPP. Idem en cas de retraite à l’âge de référence réglementaire.

Si vous prenez une retraite anticipée, vous êtes soumis·e à cotisations auprès du 1er pilier en tant que personne sans activité lucrative. Vous devez donc vous annoncer à la Caisse de compensation compétente.

Si vous avez une question, vous pouvez prendre rendez-vous avec un·e gestionnaire, directement sur notre page Prise de rendez-vous. En choisissant votre date et votre créneau horaire dans l’agenda électronique, vous pouvez sélectionner si vous préférez un rendez-vous téléphonique ou dans nos locaux.

Rendez-vous téléphonique ou dans nos locaux : possible entre 8h30 et 11h30 et entre 13h30 et 16h30, à fixer sur notre plateforme, d’une durée de 45 minutes.

Par courriel : vous pouvez aussi nous écrire en passant par notre Formulaire de contact Assurance.

Notre standard reste toujours ouvert de 9h à 12h, au numéro direct de la division Assurance +41 22 338 11 17, toutefois nous vous invitons à privilégier le rendez-vous téléphonique, pour un échange plus confortable avec votre gestionnaire.

En général

Pour vous aider à vous décrypter les termes techniques liés à la prévoyance, nous vous proposons ici leur définition, en rapport avec la CPEG. Si vous ne trouvez pas un terme, n’hésitez pas à nous le signaler afin que nous puissions compléter ce glossaire.

Age de retraite prévu par le plan (65 ans pour le plan standard et 62 ans pour le plan pénibilité), sans réduction des prestations de retraite.

Document servant à la déclaration d’impôt des membres pensionné·es. Connu aussi sous le nom d’attestation fiscale, il se présente sous la même forme qu’un certificat de salaire. A la CPEG, ce document est envoyé aux membres pensionné·es en principe à la mi-février.

On dit aussi prestation de libre passage. Il s’agit du montant que vous avez acquis et qui serait transmis à votre nouvelle institution de prévoyance en cas de changement d’employeur non affilié à la CPEG.

Ce montant acquis selon la loi fédérale sur la prévoyance vieillesse, survivants et invalidité (LPP) vous est donné à titre de comparaison dans votre certificat d’assurance, votre prestation de libre passage devant être supérieure à ce minimum légal.

Document officiel que votre Caisse est habilitée à exiger périodiquement des personnes assurées, certifiant qu’elles sont toujours en vie. Cette procédure a pour objectif de garantir que, en cas de décès, les rentes ne continuent pas à être versées à d’autres personnes que l’ayant droit.

Date correspondant à votre entrée dans la Caisse (CPEG ou anciennes caisses intégrées à la CPEG ).

Date à compter de laquelle votre durée d’assurance dans le plan de prévoyance CPEG est calculée. Cette date peut être modifiée suite à un événement comme un transfert de libre passage, un rachat ou un versement anticipé. A noter que la date d’origine des droits est une donnée technique du plan d’assurance qui ne correspond pas à la date d’affiliation.

C’est un montant qui est déduit de votre salaire brut pour obtenir votre salaire cotisant. Il permet de coordonner les prestations de la CPEG avec celles de l’AVS.

Possibilité qui vous est donnée d’utiliser tout ou partie de votre prestation de libre passage pour acquérir un logement vous servant de résidence principale. A la CPEG, ce retrait peut servir à la construction ou à l’acquisition d’un logement, à rembourser un prêt hypothécaire, à acquérir des participations dans une coopérative ou à effectuer des travaux.

Facteur de majoration appliqué à votre pension si vous continuez de travailler après l’âge de référence réglementaire . Il augmente de 3% par année supplémentaire après cet âge de référence réglementaire.

Pourcentage de réduction appliqué à votre pension en fonction de l’âge au cas où vous décidez de prendre une retraite anticipée. Ce facteur est de 100% à l’âge de référence réglementaire, il diminue pour le plan standard de 5% par année pour une anticipation de 65 à 58 ans. Pour une retraite anticipée dans le plan pénibilité, il diminue de 5 % par année de 62 ans à 58 ans.

Montant de la rente après 40 années de cotisations (correspondant actuellement à 60% du dernier traitement assuré, soit environ 50% du dernier salaire AVS). Chaque année de cotisation apporte un taux de 1.5%.

Pension à laquelle votre conjoint·e ou votre partenaire enregistré·e (selon la loi fédérale) aurait droit si vous décédez avant elle ou lui. Elle s’élèverait à 60% de la pension d’invalidité projetée (ou de la pension en cours si vous êtes déjà membre retraité·e).

Pension d’enfant d’invalide

Le montant s’élève à 20% de la pension d’invalidité (ou de la pension en cours pour un·e membre invalide) et est dû jusqu’à ce que l’enfant ait 20 ans révolus (25 ans en cas de formation).

Pension d’enfant de retraité·e

Vous n’avez droit à une pension d’enfant de membre retraité·e que si vous avez 65 ans révolus avec le plan standard (62 ans avec le plan pénibilité) et que vos enfants sont né·es avant votre départ à la retraite. La pension d’enfant s’élève à 20% d’une rente calculée par la conversion à un taux de 6,8% de l’avoir-vieillesse minimum selon l’art. 15 LPP, acquis au jour du départ en retraite, rémunéré au taux minimum LPP jusqu’au jour de son versement.

C’est le montant qui vous serait versé en cas de survenance d’une invalidité à 100% reconnue par l’AI.

Pension à laquelle vos enfants auraient droit si vous décédez avant qu’elles et ils n’aient 20 ans révolus (25 ans en cas de formation). Elle s’élèverait à 20% de la pension d’invalidité projetée (ou de la pension en cours si vous êtes déjà membre retraité·e).

Notre plan de prévoyance réservé aux membres assuré·es exerçant une activité à pénibilité, avec un âge de référence réglementaire à 62 ans. Les activités concernées figurent dans une liste publiée par le Conseil d’Etat dans le Règlement d’application de l’art. 23 de la LCPEG et ne sont pas du ressort de la Caisse.

Notre principal plan de prévoyance, avec un âge de référence réglementaire à 65 ans.

Il s’agit du montant que vous avez acquis et qui serait transmis à votre nouvelle institution de prévoyance en cas de changement d’employeur non affilié à la CPEG.

Type de plan de prévoyance qui prévoit que les prestations à verser dépendent des cotisations versées (un peu sur le modèle d’un compte d’épargne). Les cotisations de la ou du membre et de l’employeur constituent un capital augmenté d’intérêts, qui est ensuite converti en rente pour donner le montant de la pension de retraite.

Type de plan de prévoyance qui détermine la pension de retraite par un pourcentage du dernier salaire assuré et en fonction de la durée d’assurance. C’est le système défini actuellement dans la LCPEG (art. 6).

Montant que vous pouvez verser à la Caisse pour racheter des années d’assurance ou du taux moyen d’activité, afin d’améliorer vos prestations.

Il s’agit d’un rachat de cotisations, total ou partiel, que vous pouvez choisir d’effectuer, à votre charge, en cas de promotion (changement de classe) ou de réévaluation de votre fonction.

Si vous aviez atteint l’âge de 58 ans avant le 01.01.2014, le montant de votre pension acquise au 31.12.2013 vous est garanti.

Si vous aviez atteint l’âge de 58 ans avant le 01.01.2014, le montant de votre pension acquise au 31.12.2013 vous est garanti.

Prestation qui est du ressort de votre employeur. Si cette rente est versée par la CPEG, cette dernière ne le fait que pour le compte de votre employeur.

Il s’agit des montants retirés de votre prévoyance à la CPEG dans le cadre d’une procédure de divorce, qu’ils aient été ou non remboursés. Si un remboursement est intervenu, le montant remboursé figure dans votre certificat d’assurance sous «Total de vos apports».

Il s’agit des montants retirés de votre prévoyance à la CPEG pour un achat dans le cadre de l’encouragement à la propriété du logement, qu’ils aient été ou non remboursés. Si un remboursement est intervenu, le montant remboursé figure dans votre certificat d’assurance sous «Total de vos apports».

Retraite possible dès l’âge de 58 ans et moyennant une réduction de 5% par année d’anticipation par rapport à l’âge de référence réglementaire (voir facteur de réduction).

C’est le salaire qui sert au calcul des prestations. Il s’agit du traitement cotisant à 100% multiplié par le taux moyen d’activité.

Instrument permettant de calculer les rentes sur la base du capital accumulé par chaque membre durant sa vie professionnelle. Il ne s’applique pas à la CPEG, étant uniquement utilisé dans les caisses qui pratiquent la primauté des cotisations.

Le taux de la cotisation est actuellement fixé à 27% du traitement cotisant. Vous en payez 1/3, soit 9% et votre employeur ou employeuse en paie 2/3, soit 18%.

Le taux de pension sert à calculer la rente : il est appliqué au traitement assuré et correspond à la CPEG au nombre d’années d’assurance multiplié par le facteur 1,5%.

Il s’agit de la moyenne arithmétique de tous vos taux d’activité effectifs mensuels depuis votre date d’origine des droits et jusqu’à la date du certificat (TMA acquis) ou jusqu’à la date de l’âge de référence réglementaire (TMA projeté). C’est une des données utilisées dans le calcul des prestations.

C’est le traitement qui sert au calcul des cotisations. Il correspond au traitement déterminant, moins une déduction de coordination avec l’assurance fédérale vieillesse et survivants (AVS).

Il s’agit du traitement légal annuel, compte tenu de votre taux d’activité.

Documents

Please find here some documents translated in English :

Our Policyholder guide

English version of the Welcome letter

English version of the Insurance certificate

Some articles from the CPEG INFO_06

Some articles from the CPEG INFO_07

Some articles from the CPEG INFO_09

Some articles from the CPEG INFO_10

Please find the most frequently asked questions :

FAQ (selection)

Our pension simulator allows you to access relevant data, once you have filled out the blank spaces on your insurance certificate, which simulates pensions at all possible retirement ages (between 58 and 65 years).

Please bear in mind that all computations are purely indicative. A detailed report from the CPEG will be needed to confirm all data.

In the event of early retirement as relates to the standard plan, an anticipation from 65 years to 58 years costs 5 percent in reduction per annum (where strenuous physical activities are concerned, early retirement from 62 to 58 years costs 5 percent in reduction per annum).

Pensions are paid out on the last business day of the month.

The pension fund will determine whether certain survivors are entitled to death benefits (surviving spouse, divorced surviving spouse, orphans)

If the pension fund does not pay out annuities, the death benefit will amount to personal contributions and accrued interest to the deceased member.

The death benefit is then allocated based on Pension Fund regulations (article 30, alinea 3 of general regulation) or in accordance with the beneficiary clause.

In the event that there are no stated beneficiaries as per Pension Fund regulation or as defined by the deceased member, the capital will remain at the CPEG.

The Insurance Division will gladly advise you to define a beneficiary clause.

Yes, within limits determined by article 79b LPP as well as articles 60a and 60b OPP2. The Insurance Division’s service for those insured will confirm whether the purchased back payments are in conformity with the articles stated above.

As a rule, yes.

However, a tax treaty in place to prevent double taxation may state that your pension is taxable at your place of residence. The Insurance Division is at your disposal to answer all queries.

All changes must be documented in writing. You must fill out a designated form available on the website. In order to avoid errors, please provide a copy of your bank card, or bank statement along with the form.

Your employer informs CPEG of departures of salaried members.

Salaried members will need to fill out a questionnaire, dated and signed to CPEG, to ensure that vested benefit proceeds forwarded to the relevant institution.

The previous institution must be notified in writing including CPEG’s name and banking details as follows :

- Bank : BCGE, 1211 Genève 2

- Account Holder : Esplanade de Pont-Rouge 5, 1212 Grand-Lancy

- IBAN : CH 96 0078 80000 0504 09317

- SWIFT/BIC : BCGECH GGXX

- Clearing : 788

The beneficiaries are listed as recipients of any of the following benefits :

- surviving spouse pensions

- surviving divorced spouse pension

- benefits paid to a close relation, notably in the case of shared residence

- benefits for children of disabled or retired members

- orphan benefits

- pension lump sums and death benefits

Couples bonded by virtue of a registered partnership in compliance with Federal law are treated as spouses.

Contrary to AVS, there are no forms to fill out when one retires.

The employer confirms your retirement to the CPEG.

Nonetheless, a copy of the resignation letter may be sent to the CPEG for informational purposes.

All members eligible for retirement benefits (including early retirement) are authorized a lump sum equal to twenty five percent of the accumulated retirement capital (LPP). The remaining portion will be paid out in the form of a reduced pension.

Where married members are concerned, the lump sum option is available once the spouse has provided consent in writing.

If such consent cannot be obtained, the beneficiary can appeal to a judge.

Vested benefits amount to the largest of the three following propositions:

- Vested benefits in accordance with our statutes, in conformity with Article 16 of the LFLP (loi fédérale sur le libre-passage)

- The minimal amount as defined by Article 17 of the LFLP

- Accumulated pension capital as defined per Article 18 of the LFLP

Computations are determined on a set of complex calculations. Please refer to the Insurance Division, Insured Parties section, as relates to personal accounts. Please be advised that your vested benefit amount is listed on your insurance certificate.

In the event that one is employed with several employers or that one has different employment contracts with the same employer, each employer and /or contract will provide a relevant certificate.

Yes you may. You must pay a minimum amount of CHF 20.000. Payments must be in cash.

One cannot repurchase annuities or average rate of employment activity unless the total repayment of early retirement pension (resulting from a divorce and/or the acquisition of a principal residence) has been paid in full.